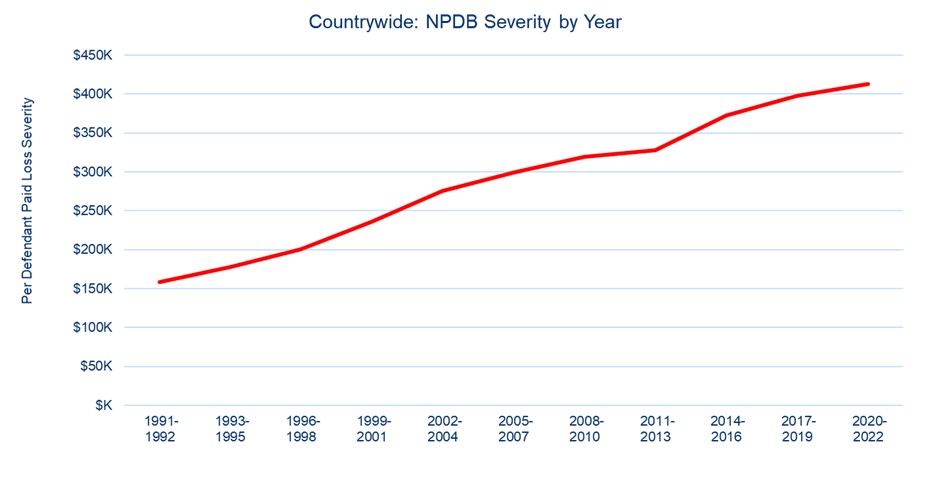

Although the number of medical professional liability (MPL) lawsuits, known as claim frequency, has decreased during the past decade, the average amount spent overall on claims, known as severity, continues to increase. Frequency did not spike even after the COVID-19 pandemic, despite predictions to the contrary. However, severity is rising due to several factors, including general inflation, what is known as social inflation, and rule changes to the tort system.

This article examines the trends behind the increase in severity, and the steps that physicians, healthcare organizations, and stakeholders can take to protect themselves. Each of the factors contributing to severity carries its own complexities, which we will explore, while providing some recommendations for steps that physicians and healthcare organizations can take to mitigate their risk.

Nearly 25 years ago, physicians successfully united and fought for tort reform across the country in response to drastic MPL insurance price increases. Physicians, other providers, and healthcare organizations again face price increases as many of the tort reform-based protections they fought for have deteriorated over time. Is a perfect storm brewing that will create a “back to the future” scenario?

Source: National Practitioner Data Bank

What’s Behind the Severity Spike?

There are several factors behind the severity spike. It is important to first understand how MPL awards and settlements are determined.

The amount of MPL awards and settlements is determined by the damages involved in an MPL incident. Damages fall into two categories: economic and noneconomic:

- Economic damages are based on financial loss, including the loss of wages, which can be significant. But the majority of economic damages consist of the money needed to treat a patient following an adverse event such as healthcare costs.

- Noneconomic damages are typically referred to as pain and suffering, which is money that does not represent financial loss, but the hardship caused by an adverse medical event.

General Inflation. General inflation, which is the tendency of prices to increase over time, affects the cost of all goods and services; healthcare is no exception. One reason is the high rate of healthcare consolidation. Drug prices keep increasing as well. Inflation for MPL claims tends to rise faster than general inflation though.

Social Inflation: An interesting phenomenon is occurring in liability claims, including MPL claims: Severity increases are considerably outpacing inflation. Many suggest that the cause is social inflation, which refers to the tendency of jurors to award massive damages due to financial desensitization.

Social inflation comes into play because jurors see evidence of large numbers being rewarded throughout society and therefore are willing to award massive damages, even when they are unrelated to any economic loss. Such noneconomic damage awards put tremendous strain on the system.

In most states, there is no limit to what jurors can award for noneconomic damages—though judges have certain discretion to reduce awards if they “shock the conscience” or exceed other thresholds. Some states have caps on noneconomic damages, though successful lobbying from the plaintiff bar has reduced this number.

Regardless, noneconomic damages continue to be problematic and undoubtedly increase the cost of insurance for physicians, which in turn increases the overall cost of healthcare. Increases in noneconomic damages do not tell the whole story though. Economic damage increases are also causing disruption.

Severity increases should correlate to rising healthcare costs and track with healthcare inflation. They should theoretically also be immune to social inflation, as they are based on the cost of providing care—not juror whims. The same is true for loss of wages.

Economic damages should not increase faster than general inflation. So why are they? Many point to life care plans, which are part of many MPL trials. Physicians and their advocates should take note.

Life Care Plans: When patients are badly injured and file MPL lawsuits, life care plans are introduced to demonstrate the amount of money needed to care for the patient due to the alleged negligence. The “value” of these plans has reportedly gotten out of control.

A primary reason is that many states permit plaintiffs to use the amount of money healthcare providers charge, which are known as charged amounts to determine the costs that make up life care plans. However, charged amounts have little relation to the amount providers get reimbursed.

Nevertheless, plaintiffs have manipulated the complex and convoluted healthcare system to use artificially high numbers in life care plans. The defense bar has been ill equipped to stop it—the plaintiff lobby is too well organized and well-funded—and the jurors, thanks to social inflation, have been willing accomplices.

Challenging life care plans has until recently been difficult. Thanks to price transparency laws though, more data exists to help defendants call into question the cost estimates of life care plans being asserted by plaintiffs. Costs should now have to be supported by evidence.

If physicians can organize to fight for reforms, they should start by ensuring that economic damages demanded in MPL lawsuits are based in reality.

Challenges with the Collateral Source Rule

In MPL cases, the damages awarded to plaintiffs for past medical expenses might not go to the plaintiffs —assuming they were paid by a “collateral source.” A collateral source generally refers to an insurance company.

By way of example, assume a patient covered by Medicare suffered from a perforated colon during a procedure. If that patient was taken to the intensive care unit (ICU) as a result, Medicare likely paid that ICU bill. If the patient sues and is awarded damages—a portion of which is for those ICU charges paid by Medicare—Medicare gets reimbursed for that portion. Federal law requires this reimbursement. Other insurance companies do not enjoy the power of the Federal government and might not be reimbursed.

Some states do not allow insurance companies to recoup damages, even if they paid them. Depending on the state, damages that were already awarded may go to the patient despite being a windfall or may just reduce the MPL award.

The physician lobby should ensure that each state with a Collateral Source Rule mandates payments go elsewhere—not to the patient. Such windfalls are misplaced and add unnecessary expense to the system. Physicians should seek to have MPL damages reduced by any amount already covered by insurance. Worst case scenario, insurance companies should be reimbursed for the money they paid.

Reimbursing insurance companies creates another interesting opportunity for physicians, thanks to the structure of certain value-based care programs.

The Value-Based Care Option

Value-based care (VBC) is a concept that refers to physicians and other entities taking financial responsibility for the healthcare costs of their patients. A popular value-based care model involves a physician group contracting with an insurance company to manage and take financial risk on the healthcare costs of its patients.

Assume a patient has an adverse event, the patient successfully sues for damages, and under the Collateral Source Rule the insurance company gets reimbursed for the expenses (damages) it has already paid. If the physician group is taking the financial risk, this group should receive that money.

A Damage ‘Bundle’

A variety of physician-led efforts to manage population health and episode of care costs have proven effective. Lessons learned from these VBC initiatives can be implemented to reduce the cost of damages awarded to injured plaintiffs.

For example, if a financial incentive was created to lower the cost of future healthcare to a plaintiff, an administrator could be appointed to do just that. Undoubtedly, a life care expert who is managing the healthcare finances for plaintiffs could significantly reduce their total costs of care. If this expert could negotiate an amount to cover all future healthcare costs—and assume the risk of excess charges—a life care bundle payment would be created.

Homecare companies are gaining in popularity, as the high and often unnecessary costs of receiving care through emergency departments are untenable. As home health programs expand, costs for life care treatment should fall precipitously.

Again, special interests will be difficult to overcome. MPL plaintiff attorneys are often paid on a percentage of damages recovered. Lower damages mean less money for plaintiff attorneys. The obvious perverse incentive to withhold care would also need to be addressed. But if physicians and the defense bar ignore strategies to reduce damages, another MPL insurance crisis might not be far off.

Is Another MPL Crisis on the Horizon?

The last MPL crisis emerged when insurance companies were financially overextended. Arguably, a major cause was the combination of the high insurance limits many physicians carried and the industry’s willingness to settle cases. Laws and rules of court favorable to the plaintiff bar made trying cases risky. Fear of losing cases at trial meant insurance companies erred on settling them. Settlements beget lawsuits, which beget settlements.

The MPL insurance industry is unique in that premiums are collected to pay claims years down the road. When carriers charge responsibly, they get the added benefit of investment income. If insurers do not charge enough, they often find out too late. It is difficult to recoup money from undercharged years. Thus was the case leading up to the last crisis. By the time the industry recognized it was ill equipped to price its way out of the gathering storm, it was already under water. Companies were facing either insolvency or massive increases. Either way, physicians organized to break the cycle and effectively lobby for tort reform.

Examples of such reforms included caps on noneconomic damages and more strict statutes of limitation and affidavits of merit requirements. Further strategies to stem the tide of lawsuits included fighting frivolous and defensible cases rather than settling. Physicians also reduced their insurance limits, which meant less money to sue for in the first place. MPL was no longer the great gold rush, and cases were no longer filed by anyone with a law degree. Calm returned.

Current State of the MPL Market: The physician-led reforms and strategies worked, leading to more than a decade of strong MPL carrier results. Carriers have wisely built up their surpluses and most have conservatively set aside money, called reserves, to pay for future lawsuits. These conservative measures have been critical to support physicians. Unfortunately, they have also masked the underlying problems with the ground lost on tort reform and increasing claim severity.

Many MPL companies are losing money on an underwriting basis but profiting from investment income from surplus and reserves accumulated from prior years. Companies have begun taking rate increases across the country, but questions remain: Is it too late, and can the increases keep up with the drastic rise in large jury verdicts?

Recent Verdicts: With severity growing, the market is tightening coverage and increasing rates. Will it be enough? To demonstrate the rise in verdict amounts, the table above shows the top 50 MPL verdicts for the years 2016 to 2023. (The amounts in the table come from a variety of sources including TransRe, Beckers Spine Review, and various articles found on the internet that were published between January 1, 2016, and April 12, 2023.)

Top 50 MPL Verdicts 2016–2023

| Year | State | Specialty/Facility | Amount |

| 2019 | MD | Obstetrics, Hospital | $229.6 |

| 2018 | MI | Pediatric Orthopedic Surgery, Hospital | $136.7 |

| 2018 | MI | Nuclear Medicine Technicians, Hospital | $130.5 |

| 2022 | GA | Caregivers, Personal Care Home | $118.0 |

| 2022 | MN | Orthopedic Surgery, Hospital | $111.3 |

| 2019 | NY | Hospital | $110.6 |

| 2018 | FL | Gynecology, Hospital | $109.0 |

| 2018 | CA | Naturopathic Practitioner | $105.0 |

| 2019 | IL | Obstetrics, Nursing, Hospital | $100.7 |

| 2022 | IA | Obstetrics, Hospital | $97.4 |

| 2022 | TX | Dentist, None | $95.5 |

| 2018 | NY | Obstetrics, Hospital | $83.7 |

| 2023 | OK | Nurse, Correctional Health | $82.0 |

| 2022 | NY | Obstetrics, Hospital | $80.0 |

| 2018 | NY | Obstetrics, Hospital | $78.7 |

| 2022 | GA | Unknown, Addiction Treatment Center | $77.0 |

| 2022 | GA | Emergency Medicine, Radiology, Hospital | $75.0 |

| 2018 | NM | Obstetrics, Hospital | $73.2 |

| 2022 | FL | Critical Care Medicine, Hospital | $68.6 |

| 2018 | CA | Cardiovascular Surgery, Hospital | $68.0 |

| 2017 | RI | Hospital | $62.0 |

| 2019 | NY | Neurosurgery, Hospital | $55.9 |

| 2016 | IL | Obstetrics, Hospital | $52.0 |

| 2018 | IL | Obstetrics, Hospital | $50.3 |

| 2016 | IL | Hospital | $50.0 |

| 2016 | NY | Obstetrics, Hospital | $50.0 |

| 2021 | CA | Paramedic, Ambulance | $49.8 |

| 2022 | IL | Radiology, Hospital | $49.0 |

| 2019 | NV | Hospital | $48.6 |

| 2018 | NY | Obstetrics, Hospital | $48.1 |

| 2017 | IL | Pediatrics | $48.0 |

| 2018 | IL | Hospital | $47.5 |

| 2017 | IL | Pediatrics | $47.5 |

| 2018 | PA | Neonatology, Hospital | $47.0 |

| 2023 | NV | Internal Medicine, Hospital | $47.0 |

| 2017 | AR | Pediatrics, Hospital | $46.5 |

| 2017 | GA | Obstetrics, Hospital | $45.8 |

| 2022 | IL | Emergency Medicine, Hospital | $45.3 |

| 2017 | NJ | Emergency Medicine, Hospital | $45.0 |

| 2016 | MD | Obstetrics, Hospital | $44.1 |

| 2016 | PA | Hospital | $44.1 |

| 2018 | OH | Family Medicine, Hospital | $44.0 |

| 2023 | PA | Orthopedic Surgery | $43.5 |

| 2018 | TX | Gastroenterology, Hospital | $43.3 |

| 2019 | CA | Senior Care | $42.5 |

| 2022 | IL | Neurosurgery, Pain Medicine, Hospital | $42.4 |

| 2017 | PA | Obstetrics | $41.5 |

| 2019 | NY | Unknown, Hospital | $41.0 |

| 2018 | FL | Obstetrics | $41.0 |

| 2018 | PA | Obstetrics, Hospital | $40.3 |

Settlements: The by-product of large verdicts is larger settlements. Fearing large verdicts, physicians and insurance companies are more inclined to settle. With the potential to win large verdicts, plaintiffs are seeking higher dollars for settlements. Sometimes they are demanding far more than insurance covers.

Two cases in New Jersey highlight the growing problem for physicians. In one case, a group was forced to pay $2.2 million above its insurance policy limits; in another, a group was forced to pay $7 million more.

Bankruptcy: The threat of bankruptcy—personal and corporate—has long deterred plaintiffs from going to trial. Even if plaintiffs win large awards, they still need to collect, which is unlikely if a defendant declares bankruptcy. Corporate bankruptcy has become a less practical means of escaping large awards though, as healthcare consolidation has resulted in medical groups often being too big to break up. Physicians can thus be left holding the bag and should explore ways to protect themselves.

Asset protection: Beyond buying insurance, there are strategies physicians can take to protect personal assets otherwise recoverable by creditors. Such asset protection strategies can depend on specific state laws, but essentially involve holding assets that are exempt in bankruptcy proceedings, such as certain qualified plans and trusts.

Increasing severity threatens the entire system. The system might need new reforms to be saved.

Lost Ground in the Tort Reform Battle

The reforms fought for and won by the last generation of physicians have been under attack for years. Following are several examples:

Noneconomic damage caps: Large verdicts may compensate a single patient but do little to improve the healthcare industry. And since they cause all insurance premiums to rise, they actually contribute to rising healthcare costs. When large verdicts are tied to financial loss or to the cost of caring for a victim of medical malpractice, it is difficult to argue against them. When massive amounts of money are awarded for “pain and suffering” though, society suffers. To mitigate the societal damage posed by outsized jury awards, many states passed legislative caps on noneconomic damages. Many of these same states have overturned their caps, including Florida, Georgia. and Illinois.

Forum Shopping: Jurors in urban areas tend to be more liberal with awards. Indeed, several counties, such as Philadelphia, Pennsylvania, and Cook County, Illinois, and Atlanta Georgia, are notorious “judicial hellholes,” according to the American Tort Reform Association Foundation.

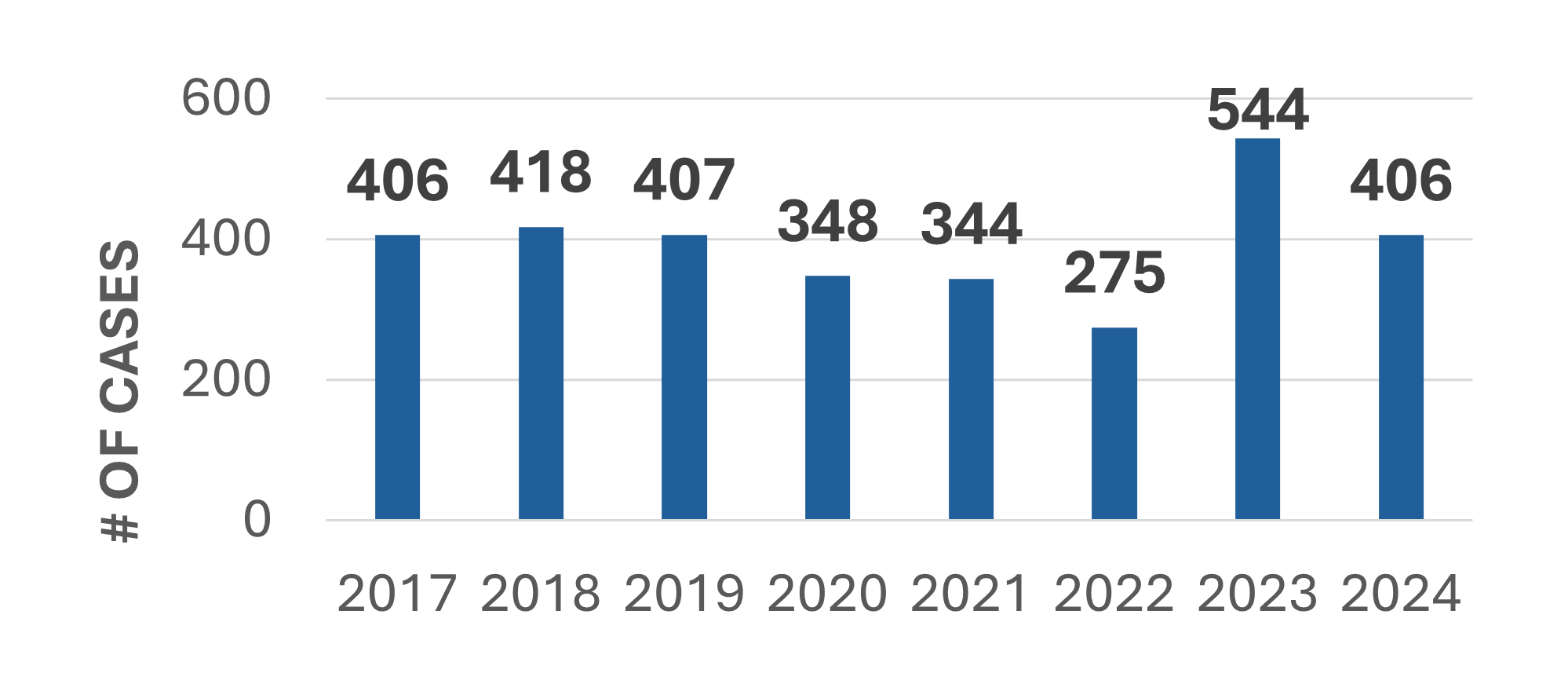

Plaintiffs in Pennsylvania would thus prefer to file a case in Philadelphia rather than Erie County. Preventing such “forum shopping” protects the integrity of the judicial system. It is also not guaranteed. Indeed, recent Pennsylvania legislation allows patients to “forum shop.”

The chart below shows the number of cases filed in Philadelphia County since the new law went into effect on January 1, 2023 (through August 2024).

Expanding Damages: For years, the plaintiff bar in New York has tried to pass legislation known as the Grieving Families Act, which would allow more than just immediate family members to recover damages in MPL cases. If successful, the MPL industry has stated that premium increases of up to 40% may be necessary.

Lobbying: Successful lobbying starts with identifying the specific problems that are causing the increases in severity, then pushing for measures to help prevent another widespread system failure. To start, physicians should understand which of the most common tort reform measures are currently in place or are realistic to get passed. Understanding damages and how they get awarded in MPL cases is essential.

Nuanced rules of litigation are again being stacked in favor of plaintiffs and the next storm is gathering. Thus far, the MPL industry has weathered it, but changes need to be made before it is again under water.

Copyright © 2024 Protects Patients Now. All Rights Reserved.